If you find you must obtain a fairly large sum of money inside of a hurry, cash-out refinancing may very well be the answer. Certainly, it provides some benefits more than other sorts of personal debt.

Understand that similar to a cash-out refinance, a HELOC or dwelling fairness loan are going to be secured by your home, which means you chance foreclosure if you can’t make your payments.

At first the virus distribute swiftest in huge metropolitan areas and metro regions where men and women are densely populated. Lockdowns and political instability caused lots of people who lived in huge towns to view minimal upside from the large rents as their favourite venus remained shut, they have been in a position to operate from your home, Operating from your home inside a cramped residence proved discouraging, and observed months of violent protests and looting sweeping across the nation Hundreds of the protests had been violent with mainstream media stores celebrating only seven% of the protests turned violent.

Incorporate a repayment start date. This can be the date your initially payment is thanks. Many lenders demand the main payment 30 times following the loan is funded.

FHA cash-out refinance loans come with Added benefits that can make them an attractive selection for homeowners planning to pull fairness from their properties.

Homeowners insurance guideHome insurance policies ratesHome insurance coverage quotesBest residence coverage companiesHome insurance coverage policies and coverageHome coverage calculatorHome insurance policies opinions

Cash-out refinancing isn’t the sole strategy to faucet into your get more info own home equity. You might also think about a house equity line of credit rating (HELOC) or a house fairness loan.

Effect on your credit may perhaps range, as credit scores are independently determined by credit rating bureaus based on quite a few things such as the fiscal conclusions you make with other money companies corporations.

Own Loan Payment Tracker: Observe your personal loan payments using this record. It is really perfect for holding track of the spending budget and keeping in addition to your individual loan payments.

SBA also assures term loans to Enhance the aggressive position of any smaller business enterprise problems adversely afflicted by import Levels of competition.

S. and is particularly open 7 times per week. Not Every person will qualify for Learn, however. Its minimum credit rating rating requirement is steep, and you'll’t add a co-borrower to make it simpler to get accredited. Study our whole Uncover particular loan evaluation.

Right after decades of having to pay on the house loan, and appreciably cutting down the principle, you'll have created fairness in your house. Any household price tag appreciation yields additional important equity. That equity could be the distinction between the balance owed with your existing home finance loan and also the residence's believed marketplace worth. Which has a cash-out refinance you faucet into your acquired fairness by refinancing your latest mortgage loan, and using out a whole new loan for much more than you continue to owe to the house.

A fast loan is just a private loan that has a rapid funding timeline. The definition of a quick funding timeline can differ, but we look at this to get exact same-working day or subsequent-day funding.

Your SSN is utilised completely to verify your identity and ensure the integrity within your software. See our Privateness Policy to check out how we share your SSN with lenders. How do I realize that my SSN will not be compromised?

Mr. T Then & Now!

Mr. T Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Burke Ramsey Then & Now!

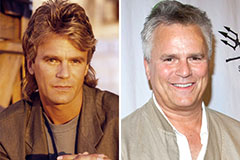

Burke Ramsey Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!